74. The Aiyagari Model#

In addition to what’s included in base Anaconda, we need to install JAX

!pip install quantecon jax

74.1. Overview#

In this lecture, we describe the structure of a class of models that build on work by Truman Bewley [Bewley, 1977].

We begin by discussing an example of a Bewley model due to Rao Aiyagari [Aiyagari, 1994].

The model features

heterogeneous agents

a single exogenous vehicle for borrowing and lending

limits on amounts individual agents may borrow

The Aiyagari model has been used to investigate many topics, including

precautionary savings and the effect of liquidity constraints [Aiyagari, 1994]

risk sharing and asset pricing [Heaton and Lucas, 1996]

the shape of the wealth distribution [Benhabib et al., 2015]

etc., etc., etc.

74.1.1. Preliminaries#

We use the following imports:

import quantecon as qe

import matplotlib.pyplot as plt

import jax

import jax.numpy as jnp

from typing import NamedTuple

from scipy.optimize import bisect

We will use 64-bit floats with JAX in order to increase precision.

jax.config.update("jax_enable_x64", True)

We will use the following function to compute stationary distributions of stochastic matrices (for a reference to the algorithm, see p. 88 of Economic Dynamics).

@jax.jit

def compute_stationary(P):

n = P.shape[0]

I = jnp.identity(n)

O = jnp.ones((n, n))

A = I - jnp.transpose(P) + O

return jnp.linalg.solve(A, jnp.ones(n))

74.1.2. References#

The primary reference for this lecture is [Aiyagari, 1994].

A textbook treatment is available in chapter 18 of [Ljungqvist and Sargent, 2018].

A continuous time version of the model by SeHyoun Ahn and Benjamin Moll can be found here.

74.2. The Economy#

74.2.1. Households#

Infinitely lived households / consumers face idiosyncratic income shocks.

A unit interval of ex-ante identical households face a common borrowing constraint.

The savings problem faced by a typical household is

subject to

where

\(c_t\) is current consumption

\(a_t\) is assets

\(z_t\) is an exogenous component of labor income capturing stochastic unemployment risk, etc.

\(w\) is a wage rate

\(r\) is a net interest rate

\(B\) is the maximum amount that the agent is allowed to borrow

The exogenous process \(\{z_t\}\) follows a finite state Markov chain with given stochastic matrix \(P\).

The wage and interest rate are fixed over time.

In this simple version of the model, households supply labor inelastically because they do not value leisure.

74.2.2. Firms#

Firms produce output by hiring capital and labor.

Firms act competitively and face constant returns to scale.

Since returns to scale are constant, the number of firms does not matter.

Hence we can consider a single (but nonetheless competitive) representative firm.

The firm’s output is

where

\(A\) and \(\alpha\) are parameters with \(A > 0\) and \(\alpha \in (0, 1)\)

\(K\) is aggregate capital

\(N\) is total labor supply (which is constant in this simple version of the model)

The firm’s problem is

The parameter \(\delta\) is the depreciation rate.

These parameters are stored in the following namedtuple:

class Firm(NamedTuple):

A: float = 1.0 # Total factor productivity

N: float = 1.0 # Total labor supply

α: float = 0.33 # Capital share

δ: float = 0.05 # Depreciation rate

From the first-order condition with respect to capital, the firm’s inverse demand for capital is

def r_given_k(K, firm):

"""

Inverse demand curve for capital. The interest rate associated with a

given demand for capital K.

"""

A, N, α, δ = firm

return A * α * (N / K)**(1 - α) - δ

Using this expression and the firm’s first-order condition for labor, we can pin down the equilibrium wage rate as a function of \(r\) as

def r_to_w(r, firm):

"""

Equilibrium wages associated with a given interest rate r.

"""

A, N, α, δ = firm

return A * (1 - α) * (A * α / (r + δ))**(α / (1 - α))

74.2.3. Equilibrium#

We construct a stationary rational expectations equilibrium (SREE).

In such an equilibrium

prices induce behavior that generates aggregate quantities consistent with the prices

aggregate quantities and prices are constant over time

In more detail, an SREE lists a set of prices, savings and production policies such that

households want to choose the specified savings policies taking the prices as given

firms maximize profits taking the same prices as given

the resulting aggregate quantities are consistent with the prices; in particular, the demand for capital equals the supply

aggregate quantities (defined as cross-sectional averages) are constant

74.3. Implementation#

Let’s look at how we might compute such an equilibrium in practice.

Below we provide code to solve the household problem, taking \(r\) and \(w\) as fixed.

74.3.1. Primitives and operators#

We will solve the household problem using Howard policy iteration (see Ch 5 of Dynamic Programming).

First we set up a NamedTuple to store the parameters that define a household asset accumulation problem, as well as the grids used to solve it

class Household(NamedTuple):

β: float # Discount factor

a_grid: jnp.ndarray # Asset grid

z_grid: jnp.ndarray # Exogenous states

Π: jnp.ndarray # Transition matrix

def create_household(β=0.96, # Discount factor

Π=[[0.9, 0.1], [0.1, 0.9]], # Markov chain

z_grid=[0.1, 1.0], # Exogenous states

a_min=1e-10, a_max=20, # Asset grid

a_size=200):

"""

Create a Household namedtuple with custom grids.

"""

a_grid = jnp.linspace(a_min, a_max, a_size)

z_grid, Π = map(jnp.array, (z_grid, Π))

return Household(β=β, a_grid=a_grid, z_grid=z_grid, Π=Π)

For now we assume that \(u(c) = \log(c)\)

u = jnp.log

Here’s a namedtuple that stores the wage rate and interest rate with default values

class Prices(NamedTuple):

r: float = 0.01 # Interest rate

w: float = 1.0 # Wages

Now we set up a vectorized version of the right-hand side of the Bellman equation (before maximization), which is a 3D array representing

for all \((a, z, a')\).

@jax.jit

def B(v, household, prices):

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

r, w = prices

# Compute current consumption as array c[i, j, ip]

a = jnp.reshape(a_grid, (a_size, 1, 1)) # a[i] -> a[i, j, ip]

z = jnp.reshape(z_grid, (1, z_size, 1)) # z[j] -> z[i, j, ip]

ap = jnp.reshape(a_grid, (1, 1, a_size)) # ap[ip] -> ap[i, j, ip]

c = w * z + (1 + r) * a - ap

# Calculate continuation rewards at all combinations of (a, z, ap)

v = jnp.reshape(v, (1, 1, a_size, z_size)) # v[ip, jp] -> v[i, j, ip, jp]

Π = jnp.reshape(Π, (1, z_size, 1, z_size)) # Π[j, jp] -> Π[i, j, ip, jp]

EV = jnp.sum(v * Π, axis=-1) # sum over last index jp

# Compute the right-hand side of the Bellman equation

return jnp.where(c > 0, u(c) + β * EV, -jnp.inf)

The next function computes greedy policies

@jax.jit

def get_greedy(v, household, prices):

"""

Computes a v-greedy policy σ, returned as a set of indices. If

σ[i, j] equals ip, then a_grid[ip] is the maximizer at i, j.

"""

# argmax over ap

return jnp.argmax(B(v, household, prices), axis=-1)

The following function computes the array \(r_{\sigma}\) which gives current rewards given policy \(\sigma\)

@jax.jit

def compute_r_σ(σ, household, prices):

"""

Compute current rewards at each i, j under policy σ. In particular,

r_σ[i, j] = u((1 + r)a[i] + wz[j] - a'[ip])

when ip = σ[i, j].

"""

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

r, w = prices

# Compute r_σ[i, j]

a = jnp.reshape(a_grid, (a_size, 1))

z = jnp.reshape(z_grid, (1, z_size))

ap = a_grid[σ]

c = (1 + r) * a + w * z - ap

r_σ = u(c)

return r_σ

The value \(v_{\sigma}\) of a policy \(\sigma\) is defined as

(See Ch 5 of Dynamic Programming for notation and background on Howard policy iteration.)

To compute this vector, we set up the linear map \(v \rightarrow R_{\sigma} v\), where \(R_{\sigma} := I - \beta P_{\sigma}\).

This map can be expressed as

(Notice that \(R_\sigma\) is expressed as a linear operator rather than a matrix—this is much easier and cleaner to code, and also exploits sparsity.)

@jax.jit

def R_σ(v, σ, household):

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

# Set up the array v[σ[i, j], jp]

zp_idx = jnp.arange(z_size)

zp_idx = jnp.reshape(zp_idx, (1, 1, z_size))

σ = jnp.reshape(σ, (a_size, z_size, 1))

V = v[σ, zp_idx]

# Expand Π[j, jp] to Π[i, j, jp]

Π = jnp.reshape(Π, (1, z_size, z_size))

# Compute and return v[i, j] - β Σ_jp v[σ[i, j], jp] * Π[j, jp]

return v - β * jnp.sum(V * Π, axis=-1)

The next function computes the lifetime value of a given policy

@jax.jit

def get_value(σ, household, prices):

"""

Get the lifetime value of policy σ by computing

v_σ = R_σ^{-1} r_σ

"""

r_σ = compute_r_σ(σ, household, prices)

# Reduce R_σ to a function in v

_R_σ = lambda v: R_σ(v, σ, household)

# Compute v_σ = R_σ^{-1} r_σ using an iterative routine.

return jax.scipy.sparse.linalg.bicgstab(_R_σ, r_σ)[0]

Here’s the Howard policy iteration

def howard_policy_iteration(household, prices,

tol=1e-4, max_iter=10_000, verbose=False):

"""

Howard policy iteration routine.

"""

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

σ = jnp.zeros((a_size, z_size), dtype=int)

v_σ = get_value(σ, household, prices)

i = 0

error = tol + 1

while error > tol and i < max_iter:

σ_new = get_greedy(v_σ, household, prices)

v_σ_new = get_value(σ_new, household, prices)

error = jnp.max(jnp.abs(v_σ_new - v_σ))

σ = σ_new

v_σ = v_σ_new

i = i + 1

if verbose:

print(f"iteration {i} with error {error}.")

return σ

As a first example of what we can do, let’s compute and plot an optimal accumulation policy at fixed prices

# Create an instance of Household

household = create_household()

prices = Prices()

r, w = prices

print(f"Interest rate: {r}, Wage: {w}")

Interest rate: 0.01, Wage: 1.0

with qe.Timer():

σ_star = howard_policy_iteration(

household, prices, verbose=True).block_until_ready()

iteration 1 with error 11.366831579022996.

iteration 2 with error 9.574522771860245.

iteration 3 with error 3.9654760004604777.

iteration 4 with error 1.1207075306313232.

iteration 5 with error 0.2524013153055833.

iteration 6 with error 0.12172293662906064.

iteration 7 with error 0.043395682867316765.

iteration 8 with error 0.012132319676439351.

iteration 9 with error 0.005822155404443308.

iteration 10 with error 0.002863165320343697.

iteration 11 with error 0.0016657175376657563.

iteration 12 with error 0.0004143776102245589.

iteration 13 with error 0.0.

0.97 seconds elapsed

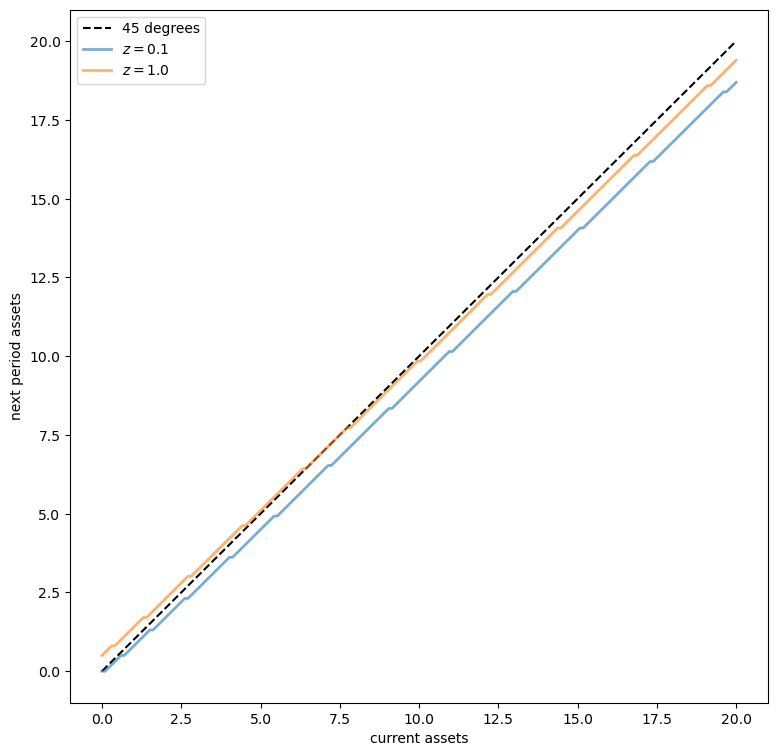

The next plot shows asset accumulation policies at different values of the exogenous state

β, a_grid, z_grid, Π = household

fig, ax = plt.subplots(figsize=(9, 9))

ax.plot(a_grid, a_grid, 'k--', label="45 degrees")

for j, z in enumerate(z_grid):

lb = f'$z = {z:.2}$'

policy_vals = a_grid[σ_star[:, j]]

ax.plot(a_grid, policy_vals, lw=2, alpha=0.6, label=lb)

ax.set_xlabel('current assets')

ax.set_ylabel('next period assets')

ax.legend(loc='upper left')

plt.show()

The plot shows asset accumulation policies at different values of the exogenous state.

74.3.2. Capital supply#

To start thinking about equilibrium, we need to know how much capital households supply at a given interest rate \(r\).

This quantity can be calculated by taking the stationary distribution of assets under the optimal policy and computing the mean.

The next function computes the stationary distribution for a given policy \(\sigma\) via the following steps:

Compute the stationary distribution \(\psi = (\psi(a, z))\) of \(P_{\sigma}\), which defines the Markov chain of the state \((a_t, z_t)\) under policy \(\sigma\).

Sum out \(z_t\) to get the marginal distribution for \(a_t\).

@jax.jit

def compute_asset_stationary(σ, household):

# Unpack

β, a_grid, z_grid, Π = household

a_size, z_size = len(a_grid), len(z_grid)

# Construct P_σ as an array of the form P_σ[i, j, ip, jp]

ap_idx = jnp.arange(a_size)

ap_idx = jnp.reshape(ap_idx, (1, 1, a_size, 1))

σ = jnp.reshape(σ, (a_size, z_size, 1, 1))

A = jnp.where(σ == ap_idx, 1, 0)

Π = jnp.reshape(Π, (1, z_size, 1, z_size))

P_σ = A * Π

# Reshape P_σ into a matrix

n = a_size * z_size

P_σ = jnp.reshape(P_σ, (n, n))

# Get stationary distribution and reshape back onto [i, j] grid

ψ = compute_stationary(P_σ)

ψ = jnp.reshape(ψ, (a_size, z_size))

# Sum along the rows to get the marginal distribution of assets

ψ_a = jnp.sum(ψ, axis=1)

return ψ_a

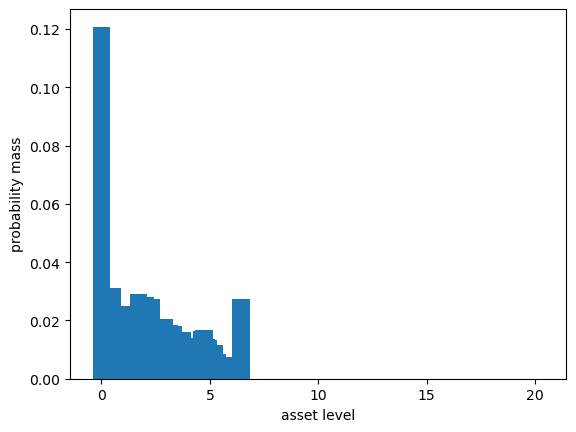

Let’s give this a test run.

ψ_a = compute_asset_stationary(σ_star, household)

fig, ax = plt.subplots()

ax.bar(household.a_grid, ψ_a)

ax.set_xlabel("asset level")

ax.set_ylabel("probability mass")

plt.show()

The distribution should sum to one:

ψ_a.sum()

Array(1., dtype=float64)

The next function computes aggregate capital supply by households under policy \(\sigma\), given wages and interest rates

def capital_supply(σ, household):

"""

Induced level of capital stock under the policy, taking r and w as given.

"""

β, a_grid, z_grid, Π = household

ψ_a = compute_asset_stationary(σ, household)

return float(jnp.sum(ψ_a * a_grid))

74.3.3. Equilibrium#

We compute a SREE as follows:

Set \(n=0\) and start with an initial guess \(K_0\) for aggregate capital.

Determine prices \(r, w\) from the firm decision problem, given \(K_n\).

Compute the optimal savings policy of households given these prices.

Compute aggregate capital \(K_{n+1}\) as the mean of steady-state capital given this savings policy.

If \(K_{n+1} \approx K_n\), stop; otherwise, go to step 2.

We can write the sequence of operations in steps 2-4 as

If \(K_{n+1}\) agrees with \(K_n\) then we have a SREE.

In other words, our problem is to find the fixed point of the one-dimensional map \(G\).

Here’s \(G\) expressed as a Python function

def G(K, firm, household):

# Get prices r, w associated with K

r = r_given_k(K, firm)

w = r_to_w(r, firm)

# Generate a household object with these prices, compute

# aggregate capital.

prices = Prices(r=r, w=w)

σ_star = howard_policy_iteration(household, prices)

return capital_supply(σ_star, household)

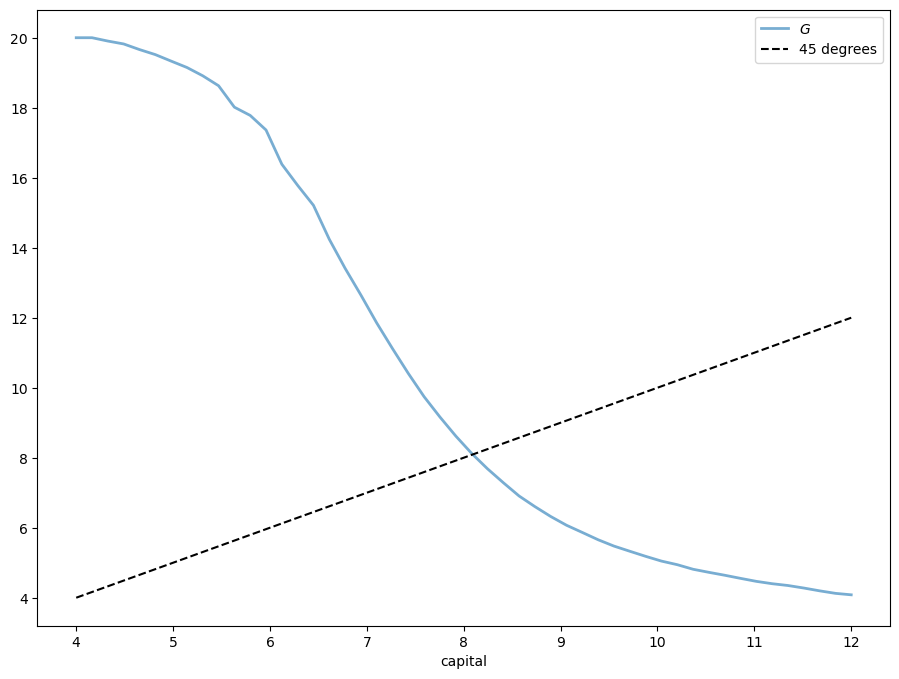

Let’s inspect visually as a first pass

num_points = 50

firm = Firm()

household = create_household()

k_vals = jnp.linspace(4, 12, num_points)

out = [G(k, firm, household) for k in k_vals]

fig, ax = plt.subplots(figsize=(11, 8))

ax.plot(k_vals, out, lw=2, alpha=0.6, label='$G$')

ax.plot(k_vals, k_vals, 'k--', label="45 degrees")

ax.set_xlabel('capital')

ax.legend()

plt.show()

Now let’s compute the equilibrium.

Looking at the figure above, we see that a simple iteration scheme \(K_{n+1} = G(K_n)\) will cycle from high to low values, leading to slow convergence.

As a result, we use a damped iteration scheme of the form

def compute_equilibrium(firm, household,

K0=6, α=0.99, max_iter=1_000, tol=1e-4,

print_skip=10, verbose=False):

n = 0

K = K0

error = tol + 1

while error > tol and n < max_iter:

new_K = α * K + (1 - α) * G(K, firm, household)

error = abs(new_K - K)

K = new_K

n += 1

if verbose and n % print_skip == 0:

print(f"At iteration {n} with error {error}")

return K, n

firm = Firm()

household = create_household()

print("\nComputing equilibrium capital stock")

with qe.Timer():

K_star, n = compute_equilibrium(firm, household, K0=6.0)

print(f"Computed equilibrium {K_star:.5} in {n} iterations")

Computing equilibrium capital stock

36.11 seconds elapsed

Computed equilibrium 8.0918 in 176 iterations

This convergence is not very fast, given how quickly we can solve the household problem.

You can try varying \(\alpha\), but usually this parameter is hard to set a priori.

In the exercises below you will be asked to use bisection instead, which generally performs better.

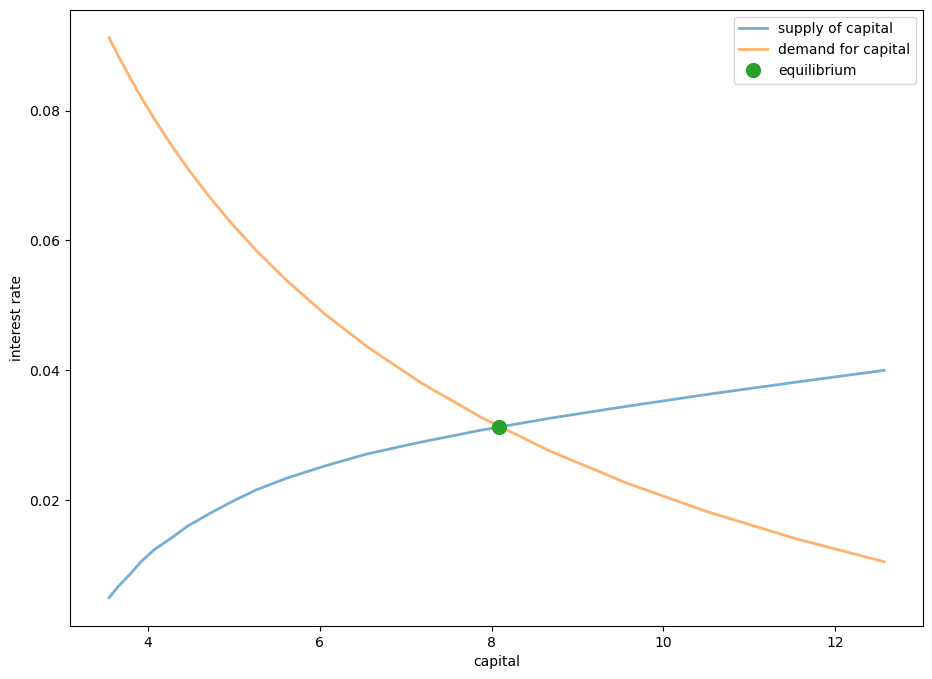

74.3.4. Supply and demand curves#

We can visualize the equilibrium using supply and demand curves.

The following code draws the aggregate supply and demand curves.

The intersection gives the equilibrium interest rate and capital

def prices_to_capital_stock(household, r, firm):

"""

Map prices to the induced level of capital stock.

"""

w = r_to_w(r, firm)

prices = Prices(r=r, w=w)

# Compute the optimal policy

σ_star = howard_policy_iteration(household, prices)

# Compute capital supply

return capital_supply(σ_star, household)

# Create a grid of r values to compute demand and supply of capital

num_points = 20

r_vals = jnp.linspace(0.005, 0.04, num_points)

# Compute supply of capital

k_vals = []

for r in r_vals:

k_vals.append(prices_to_capital_stock(household, r, firm))

# Plot against demand for capital by firms

fig, ax = plt.subplots(figsize=(11, 8))

ax.plot(k_vals, r_vals, lw=2, alpha=0.6,

label='supply of capital')

ax.plot(k_vals, r_given_k(

jnp.array(k_vals), firm), lw=2, alpha=0.6,

label='demand for capital')

# Add marker at equilibrium

r_star = r_given_k(K_star, firm)

ax.plot(K_star, r_star, 'o', markersize=10, label='equilibrium')

ax.set_xlabel('capital')

ax.set_ylabel('interest rate')

ax.legend(loc='upper right')

plt.show()

74.4. Exercises#

Exercise 74.1

Write a new version of compute_equilibrium that uses bisect from scipy.optimize instead of damped iteration.

See if you can make it faster than the previous version.

In bisect,

you should set

xtol=1e-4to have the same error tolerance as the previous version.for the lower and upper bounds of the bisection routine try

a = 1.0andb = 20.0.

Solution to Exercise 74.1

We use bisection to find the zero of the function \(h(k) = k - G(k)\)

def compute_equilibrium_bisect(firm, household, a=1.0, b=20.0):

K = bisect(lambda k: k - G(k, firm, household), a, b, xtol=1e-4)

return K

firm = Firm()

household = create_household()

print("\nComputing equilibrium capital stock using bisection")

with qe.Timer():

K_star = compute_equilibrium_bisect(firm, household)

print(f"Computed equilibrium capital stock {K_star:.5}")

Computing equilibrium capital stock using bisection

0.85 seconds elapsed

Computed equilibrium capital stock 8.0938

The bisection method is faster than the damped iteration scheme.

Exercise 74.2

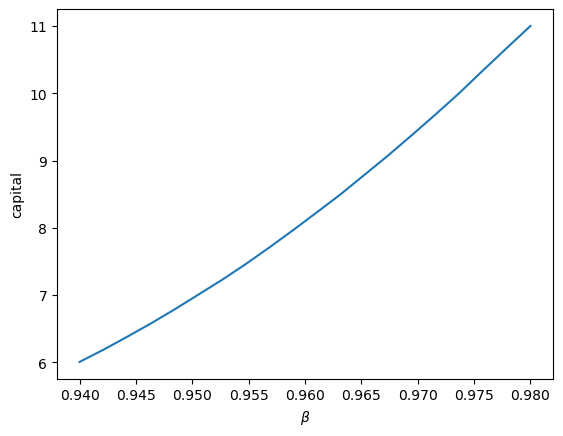

Show how equilibrium capital stock changes with \(\beta\).

Use the following values of \(\beta\) and plot the relationship you find.

β_vals = jnp.linspace(0.94, 0.98, 20)

Solution to Exercise 74.2

K_vals = []

K = 6.0 # initial guess

for β in β_vals:

household = create_household(β=β)

K = compute_equilibrium_bisect(firm, household, 0.5 * K, 1.5 * K)

print(f"Computed equilibrium {K:.4} at β = {β}")

K_vals.append(K)

fig, ax = plt.subplots()

ax.plot(β_vals, K_vals, ms=2)

ax.set_xlabel(r'$\beta$')

ax.set_ylabel('capital')

plt.show()

Computed equilibrium 6.006 at β = 0.94

Computed equilibrium 6.186 at β = 0.9421052631578948

Computed equilibrium 6.379 at β = 0.9442105263157894

Computed equilibrium 6.577 at β = 0.9463157894736841

Computed equilibrium 6.786 at β = 0.9484210526315789

Computed equilibrium 7.005 at β = 0.9505263157894737

Computed equilibrium 7.226 at β = 0.9526315789473683

Computed equilibrium 7.461 at β = 0.9547368421052631

Computed equilibrium 7.709 at β = 0.9568421052631579

Computed equilibrium 7.966 at β = 0.9589473684210527

Computed equilibrium 8.231 at β = 0.9610526315789474

Computed equilibrium 8.499 at β = 0.963157894736842

Computed equilibrium 8.787 at β = 0.9652631578947368

Computed equilibrium 9.076 at β = 0.9673684210526317

Computed equilibrium 9.378 at β = 0.9694736842105263

Computed equilibrium 9.687 at β = 0.971578947368421

Computed equilibrium 10.0 at β = 0.9736842105263158

Computed equilibrium 10.34 at β = 0.9757894736842105

Computed equilibrium 10.67 at β = 0.9778947368421053

Computed equilibrium 11.0 at β = 0.98